Last updated: 10 Feb 2025 03:00 Posted in: AIA

The UK government has announced new regulations confirming changes to company sizes, affecting both reporting requirements and the need for an audit to be held. New rules are set out within The Companies (Accounts and Reports) (Amendment and Transitional Provision) Regulations 2024. The uplift in thresholds is part of a response to cutting complexity and to attempt to reduce reporting burden on companies, but also accounts for the impact of inflation since the previous thresholds were set in 2013.The new rules apply for periods beginning on or after 6 April 2025.

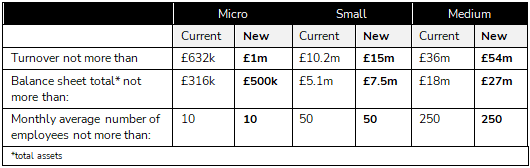

The small company exemption has been raised from a turnover of not more than £10.2m to £15m, with companies of assets of not more than £7.5m now qualifying for small company categorisation.

New and updated thresholds

The increased thresholds will also apply to limited liability partnerships (LLPs) via additional amendments to regulations.

How the threshold changes affect reporting

The new regulations are expected to cause approximately 113,000 companies and LLPs to shift from the small to micro-entity category, 14,000 from medium-sized to small, and 6,000 from large to medium-sized. Companies that move down a size category will benefit from reduced reporting and audit requirements.

For entities transitioning to the small-entities regime, the changes will be substantial. They will no longer need to conduct a statutory audit of their annual accounts (with some exceptions related to group membership) and will be exempt from producing a Strategic Report. Additionally, they can adopt simpler accounting requirements. Those moving to the micro-entities regime will also be exempt from producing a Directors’ Report.

Entities moving from the large to medium-sized category will gain exemptions from certain Strategic Report requirements, including the Section 172(1) statement, which details how directors have considered stakeholder and other interests as outlined in Section 172 of the Companies Act 2006.

The legislation includes a transitional provision for the “two-year consecutive rule.” When determining company size for a financial year starting on or after 6 April 2025, this provision allows preparers to assume that the new thresholds were in place during the previous financial year. This look-back is only applicable for the two-year rule, enabling companies and LLPs to benefit from the threshold uplift as soon as the legislation is enacted.

Changes to Directors’ Report requirements

To further reduce the UK’s regulatory burden, particularly regarding non-financial reporting, the new regulations have also removed a number of obsolete or overlapping requirements relating to the contents of the Directors’ Report.

Large and medium-sized entities will no longer be required to include in their Directors’ Report information on:

Further information on the changes is explained within the government’s published explanatory memorandum.

Guidance updates

Guidance will be updated accordingly with changes to the reporting thresholds from relevant regulatory authorities.

Companies House guidance details the company size thresholds relevant for reporting for the three classifications: micro-entity, small, and medium-sized; and the ineligibility criteria.

The Financial Reporting Council develops and maintains UK accounting standards and issues guidance on aspects of corporate reporting. The relevant accounting standards will be updated to reflect new monetary thresholds in due course; and guidance that refers to any of the reporting requirements removed by this legislation will be updated accordingly.

HMRC will also publish updated guidance to reflect how the size threshold uplifts will impact off-payroll working tax rules, under the Income Tax (Earnings and Pensions) Act 2003.